Is the Fed Bailing Out the Banks Again

The Occupy Wall Street movement began in September of 2011 and spread worldwide.

"We're looking at a grade of corporate tyranny previously unseen in America."

Pam Martens, Wall Street on Parade.

by Brian Shilhavy

Editor, Health Impact News

Pam and Russ Martens of Wall Street on Parade have reported on the huge banking company bailouts during the quaternary quarter of 2019, months before COVID was declared to exist a "pandemic" giving farther evidence from a series of events at the cease of 2019 that the "state of war on the virus" that has enslaved the entire world, was all planned long in accelerate by the Globalists.

Not reported in the media, either corporate news media nor anywhere else in the Culling Media that I have seen, the Martens take exposed the fact that the bailouts of the biggest banks in New York far exceeded the bailouts during the 2008 financial crises, which of form was headline news dorsum so.

This bailout of Wall Street in 2008 was the fuel that gave rising to the "Occupy Wall Street" movement that started in September of 2011, and spread around the earth.

Unfortunately, the motion failed to create any lasting solutions, primarily because the Globalists and their corporate media painted it equally a Liberal, Democratic motility, keeping well-nigh Conservative, Republicans on the sidelines.

I am agape that the same failure awaits us in 2022, unless we learn to rise up together as AMERICANS, united together and non divided by the Left and Right image, and the decadent two political party system that only gives us choices of either Republican or Autonomous criminals all controlled by Wall Street, to put into political office to serve the bankers, and non the people.

The Fed'southward Power-Motion in 2019 Exposed

In their first commodity on this news published on December 29, 2021, titled: The Fed Is About to Reveal Which Wall Street Banks Needed $4.v Trillion in Repo Loans in Q4 2019, the Martens reported:

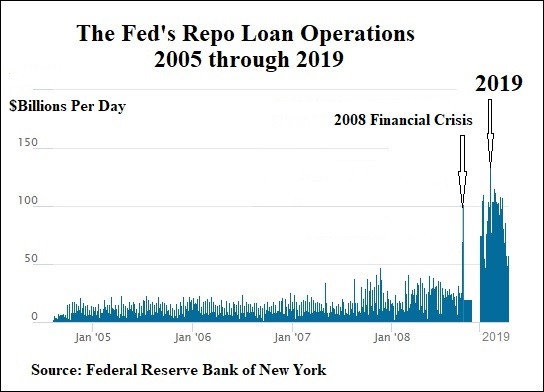

The conventional wisdom is that the Fed's recent emergency lending facilities to Wall Street were acquired by the COVID-19 crisis. The in a higher place chart, which uses the New York Fed's own Excel spreadsheet repo loan data, shows the conventional wisdom is dangerously wrong.

In the final quarter of 2019 – before there was any news of COVID-xix in the U.S., and months before the Globe Health Organization declared COVID-19 a pandemic – the Fed pumped $4.5trillion in cumulative repo loans to unnamed trading houses on Wall Street – its so-called "primary dealers."

The collateral that the Fed accepted for the cumulative $four.five trillion in loans consisted of $three.497 trillion in U.S. Treasury securities; $988.three billion in agency Mortgage-Backed Securities (MBS); and $fifteen.839 billion in agency debt.

The Fed's emergency repo loan operations began on September 17, 2019. From September 17, 2019 through the final acknowledged operation on July ii, 2020, the Fed'southward repo loans cumulatively totaled $xi.23trillion, made up of the following pledged collateral: $seven.137 trillion in U.S. Treasury securities; $4 trillion in agency Mortgage-Backed Securities (MBS) and $91.525 billion in agency debt.

But how frail were Wall Street's trading houses at that time that they needed to continuously roll over loans from the Fed – some on an overnight footing, others for weeks at a time? A quick estimate of the depth of the crunch in the last four months of 2019 is to compare the full of repo loans made in the 2008 financial crisis to those made in 2019. We've provided the nautical chart at the pinnacle of this article for a quick snapshot.

The 2008 financial crunch was the worst in the U.s. since the Groovy Depression. Century-erstwhile Wall Street financial institutions were collapsing similar a firm of cards. And yet, the Fed only funneled a total of $3.144 trillion in repo loans to its primary dealers from January 2 through December 30, 2008. Instead, the Fed decided to gear up an alphabet soup listing of emergency bailout facilities through which it secretly issued $29 trillion in cumulative loans from Dec 2007 to July 2010.

The Fed rolled out many of those same 2008 emergency bailout facilities beginning in March of 2020 after the Globe Health Organization declared a pandemic on March 11.

Looking at the chart above and now having the precise tally of the $11.23 trillion in cumulative repo loans the Fed made from September 17, 2019 through July two, 2020, it now appears that the bulk of the emergency repo loans were a stand-in functioning until the Fed could roll out its full ensemble of emergency lending programs, which it carefully characterized as "in response to COVID-19."

So the question is, if the pandemic was officially alleged on March xi, 2020 and the showtime case of COVID-xix in the U.S. was confirmed by the CDC on January 20, 2020 – what caused the financial emergency on Wall Street in the fall of 2019 that required trillions of dollars in repo loan bailouts from the Fed?

The Fed has failed to provide any apparent answers to that question.

Under Section 1103 of the Dodd-Frank fiscal reform legislation of 2010, the Fed has to disclose to the public its repo lending operations "on the terminal twenty-four hours of the eighth agenda quarter post-obit the calendar quarter in which the covered transaction was conducted." That means that the names of the banks and the amounts they borrowed from the Fed'south repo loan operations for the fourth quarter of 2019 are legally required to exist reported this Friday (Dec 31, 2021).

Read the total article.

The Fed actually released the data a day early on, on December 30, 2021, and the Martens published their 2d commodity on this news the following day, on New year's Eve, Dec 31, 2021: By Pancaking Term Loans, JPMorgan Had $30 Billion Outstanding from the Fed'southward Emergency Repo Loans in the Concluding Quarter of 2019.

Excerpts:

Jamie Dimon, Chairman and CEO of JPMorgan Hunt, likes to perpetually brag about his depository financial institution's "fortress balance sheet." But in the autumn of 2019, that fortress needed to borrow huge sums of money from the Federal Reserve – for still unexplained reasons. The trading units of other Wall Street banks also borrowed big sums from the Fed but they oasis't branded themselves as the "fortress residue sheet."

Yesterday, the Federal Reserve Bank of New York released the names of the banks and the dollar amounts that were borrowed under its emergency repo loan operations for the last quarter of 2019.

Repo loans, short for repurchase agreements, are supposed to be overnight loans. Corporations, banks, securities firms and coin market mutual funds typically secure these loans from each other by providing prophylactic forms of collateral such as Treasury securities.

The repo loan market is supposed to part without the assistance of the Federal Reserve. The Fed's emergency repo loans that began on September 17, 2019 (months earlier in that location was a COVID-19 case reported anywhere in the globe) was the first such repo intervention by the Fed since the financial crunch of 2008.

The Fed has still to provide a apparent explanation for why its emergency operations were needed.

The Fed's emergency repo operations began equally overnight loans. But then the Fed began regularly offering 14-twenty-four hours term loansin add-on to the overnight loans. And then it began to add even longer term loans.

Just 24 trading houses on Wall Street (what the Fed calls its "primary dealers") were eligible for these loans. A handful of firms took the panthera leo'due south share. Until now, neither the public nor the participating banks knew who was under the most severe funding stresses that they had to borrow from the Fed for months on finish.

This is an instance of how the trading unit of JPMorgan Hunt, J.P. Morgan Securities, pancaked these term loans from the Fed to amass a $30 billion outstanding loan from the Fed:

On November 12, the Fed offered a 14-twenty-four hours term loan that would expire on Nov 26. J.P. Morgan Securities took iii separate lots totaling $7 billion.

On November 14, the Fed offered a 13-day term loan that would elapse on November 27. J.P. Morgan Securities took $five billion of that.

On November 19, the Fed offered a 14-day term loan expiring on December three. J.P. Morgan Securities took $4 billion of that.

On November 21, the Fed offered another 14-day term loan expiring on December five. J.P. Morgan Securities took 2 lots totaling $v billion.

On November 25, the Fed offered its first 42-24-hour interval term loan expiring on January 6. The loan settled on aforementioned-day terms. J.P. Morgan Securities took two lots totaling $4 billion.

At this point in fourth dimension, the November 12 loan, gear up to expire on November 26, had not come due so J.P. Morgan Securities had $25 billion in term loans with the Fed and also had $5 billion in overnight loans maturing the next twenty-four hours for a total of $xxx billion outstanding.

And on and on it went.

Other banks that were taking large amounts of term loans and pancaking them on top of each other include Goldman Sachs, Nomura Securities International, Citigroup Global Markets, Deutsche Depository financial institution, Banking company of America Securities, Cantor Fitzgerald, as well as others.

There are a few key takeaways from the newly released data. The first takeaway is that the Fed was not created to bail out the trading firms on Wall Street. Its mandate throughout its 108-yr history is to be a Lender-of-Last-Resort to commercial banks so that its power to electronically create coin out of thin air is used to benefit the productive portions of the economy, non speculators on Wall Street.

This is now the 2d time since 2008 that the Fed has jumped in with both feet to bail out trading houses. This time around, the public and Congress take been denied an caption as to what caused this financial crisis in the fall of 2019.

The second takeaway is that by releasing this data in quarterly chunks, the Fed is making it impossible to see the big motion-picture show. Did JPMorgan's term loans grow to $fifty billion past the adjacent quarter? There's no way to know at this indicate because that information has not been released.

The third takeaway is that units of JPMorgan Chase were also eligible to borrow, get-go in March 2020, under other emergency loan facilities set by the Fed, such as the Primary Dealer Credit Facility. How much did information technology owe to the Fed nether all of these various programs? That data has as well not been released.

The Fed stonewalled the media in court for more than than two years afterwards the 2008 financial crisis, refusing to release its emergency loan data. It's starting to seem similar this is a feature, not a bug, at the Fed. The Fed lost at a Federal District Court and a Federal Appellate Court and the U.S. Supreme Courtroom refused to hear the case. When the Levy Economic science Institute tallied upwardly all of the emergency programs, the cumulative tally came to a $29 trillion bailout.

You lot can download the repo loan data from the New York Fed at this link.

Their adjacent article was published on Jan 2, 2022, where they expressed their shock that this rape of America's finances was non covered by the media, as there appeared to be a news coma with many of the top financial journalists and reporters evidently nether a gag order to not cover the story.

There's a News Blackout on the Fed'due south Naming of the Banks that Got Its Emergency Repo Loans; Some Journalists Appear to Exist Nether Gag Orders

Excerpts:

4 days ago, the Federal Reserve released the names of the banks that had received $4.5trillion in cumulative loans in the last quarter of 2019 nether its emergency repo loan operations for a liquidity crisis that has nevertheless to be credibly explained.

Among the largest borrowers were JPMorgan Chase, Goldman Sachs and Citigroup, iii of the Wall Street banks that were at the center of the subprime and derivatives crisis in 2008 that brought down the U.S. economic system.

That's blockbuster news. Simply as of 7 a.1000. this morning, non i major business media outlet has reported the details of the Fed's big reveal.

Under the Dodd-Frank financial reform legislation of 2010, the Fed was legally required to release the names of the banks and the amounts they borrowed "on the last mean solar day of the eighth calendar quarter following the agenda quarter in which the covered transaction was conducted." The New York Fed released the information for the third quarter of 2019 last Th, a day earlier than required.

Nosotros reported on it the following day.

Those Fed revelations, that had been withheld from the American people for two years, should have made front page headlines in newspapers and on the digital front pages of every major business organisation news outlet.

Instead, at that place was a universal news blackout of the story at the largest business news outlets, including: Bloomberg News, the Wall Street Journal, the business organization section of the New York Times, the Financial Times, Dow Jones' MarketWatch, and Reuters.

Could this critically important story accept simply slipped past all of the dozens of investigative reporters and Fed watchers at these news outlets?

Absolutely not.

The Fed was required to release its repo loan information and names of the banks for the span of September 17 through September thirty, 2019 at the end of the third quarter of this year.

We reported on what that information revealed on October 13. Because we were similarly stunned past the news blackout on that Fed release, out of courtesy nosotros sent our story to the reporters covering the Fed for the major news outlets.

Our article alerted each of these reporters that a much larger information release from the Fed, for the total fourth quarter of 2019, would exist released on or nearly Dec 31. The data was posted at the New York Fed erstwhile before 1:23 p.k. ET last Thursday.

The about puzzling office of this news blackout is that the majority of the reporters who covered this Fed story at the time it was happening in 2019, are still employed at the aforementioned news outlets.

We emailed a number of them and asked why they were non covering this important story.

Silence prevailed. We then emailed the media relations contacts for the Wall Street Periodical, the New York Times, the Fiscal Times and the Washington Post, inquiring as to why there was a news coma on this story.

Over again, silence.

Adjacent, we emailed a number of reporters who had covered this story in 2019 but were no longer employed at a major news outlet. Nosotros asked their opinion on what could explain this bizarre news coma on such a major financial story.

We received emails praising our reporting but advising that they "can't comment."

The phrase "tin can't annotate" as opposed to "don't wish to comment" raised a major alarm bong. Wall Street megabanks are notorious for demanding that their staff sign non-disclosure agreements and not-disparagement agreements in club to get severance pay and other benefits when they are terminated.

Are the newsrooms covering Wall Street megabanks at present enervating like gag orders from journalists?

If they are, we're looking at a form of corporate tyranny previously unseen in America.

We've never before seen a total news blackout of a financial news story of this magnitude in our 35 years of monitoring Wall Street and the Fed. (Nosotros take, still, documented a pattern of corporate media censoring news well-nigh the crimes of Wall Street'due south megabanks.)

Theories abound as to why this current story is off limits to the media. One theory goes similar this: the Fed has made headlines around the earth in recent months over its own trading scandal – the worst in its history.

Granular details of just how deep this Fed trading scandal goes accept also been withheld from the public likewise as members of Congress.

If the media were now to focus on yet another scandal at the Fed – such as it bailing out the banks in 2019 considering of their own hubris once once again – there might be legislation introduced in Congress to strip the Fed of its supervisory role over the megabanks and a restoration of the Drinking glass-Steagall Human action to divide the federally-insured commercial banks from the trading casinos on Wall Street.

Why might such an consequence be a problem for media outlets in New York City?

Three of the serially charged banks (JPMorgan Chase, Goldman Sachs and Citigroup) are actually owners of the New York Fed – the regional Fed bank that played the major role in doling out the bailout money in 2008, and again in 2019.

The New York Fed and its unlimited power to electronically print money, are a boon to the New York City economic system, which is a boon to advertizement revenue at the big New York Metropolis-based media outlets.

Read the full article hither.

Too the "big New York City-based media outlets," here is a list of New York'due south meridian 10 largest businesses based on employees (source):

- IBM (Jobs)

- Banking concern of China (Jobs)

- Healthfield Operating Group (Jobs)

- Deloitte (Jobs)

- PepsiCo (Jobs)

- JPMorgan Chase Co. (Jobs)

- Citicorp (Jobs)

- Citigroup (Jobs)

- Moscow Cablecom (Jobs)

- Sheraton Hotels and Resorts (Jobs)

Donald Trump, who was the President of the United States when all these banks were creating money to give to themselves at the end of 2019, as well has significant business holdings in New York Metropolis, as does Pfizer.

And while Trump is currently making the media rounds to promote his Pfizer bioweapon shots, and telling his fanatic followers that he is against mandating the gene-altering shots, if you endeavor to accept dinner or enter his Trump Towers in NYC, this is the sign you will see.

This is not a simple blackness and white printout issued by the Health Section, but a peculiarly-made sign with a gilt frame that Trump's corporation fabricated mandating the COVID-19 shots equally a status to enter their belongings.

So much for being "confronting mandates." Trump has e'er been a person where you need to ignore what comes out of his mouth, and actually sentry what he does.

After publishing their third article on this coup past the Fed and their banks, the media still has non picked information technology up (as far equally I tin can see), only the users of Reddit did, and it went viral so fast, that it crashed the Martens' website for near of the day yesterday.

Here is what they published today:

Redditors Raged Against the News Blackout of the Fed'due south Bailout – And then All Hell Broke Loose When They Learned the Wall Street Banks Literally Own the New York Fed

Excerpts:

We were attempting to hold the Fed, Large Media, and the Wall Street megabanks accountable with our article yesterday on mainstream media's news coma of the Fed's release of the names of the Wall Street trading houses that got $4.5trillion in cumulative repo loans from the Fed in the last quarter of 2019 – long before the get-go case of COVID-nineteen was reported in the U.S. on January 20, 2020. (The full tally came to $xi.23trillion in cumulative repo loans from September 17, 2019 through July 2, 2020.)

But when a Reddit group that calls itself "Superstonk" spotted our commodity and posted it in their annotate section, our website got caught in the crosshairs. The traffic to our article was so heavy at times that our website couldn't be accessed from either a laptop or a cell phone.

Here's the timeline of what we know so far about what happened:

Soon after tiffin yesterday, I attempted to access a different article on our website to review data for another commodity I was working on.

The site wouldn't open. I tried my cell telephone and got an error/timed-out bulletin.

I chosen our tech back up team and was informed that we had plenty of bandwidth just too many people were attempting to access the website at the exact same time. Tech back up said they were going to deploy some software to help the situation.

At 2:41 p.grand. EST, I received an email from an private who said he had posted our article to a Reddit forum known equally Superstonk and that it had "made it to the front page of Reddit."

Nosotros're not savvy about social media but making it to the front page of Reddit can apparently exist both a blessing and a curse. A approval in terms of getting the story out to our fellow Americans, and a curse in terms of keeping our website running.

We decided to accept a await at the comments department of Reddit's Superstonk under where our article had been posted.

Folks were outraged that this kind of cronyism is all the same going on between the Fed and the banks after their hubris during and afterward the financial crisis of 2008, and that the media won't even report it to the public.

The rage on that attribute of our article was intense, then someone on Reddit Superstonk noticed this office of our commodity yesterday:

"Three of the serially charged banks (JPMorgan Hunt, Goldman Sachs and Citigroup) are actually owners of the New York Fed – the regional Fed banking concern that played the major function in doling out the bailout money in 2008, and again in 2019. The New York Fed and its unlimited power to electronically impress money, are a boon to the New York Urban center economy, which is a boon to advertising revenue at the big New York Metropolis-based media outlets."

That really striking a nerve – as it should. One commenter calling himself ItalicsWhore posted this:

"Wait. The banks…own the New York Fed…and tin loan themselves unlimited amounts of money at practically 0% interest… in underground…? What. The. F***" [Asterisks added.]

Then a person posting under the name d-Loop responded:

"Kinda makes the whole thing striking a little unlike with that piece of info doesn't it!

"Everyone is out there digging for the reason they'd demand that money in that timeframe, and I'k over here merely trying not to throw up from the federal incest."

"Federal incest" is an excellent phrase to add together to the Wall Street/Fed lexicon. It peculiarly comes to heed when we think of the former Chair of the Fed, Janet Yellen, who went straight from her perch at the Fed to grabbing millions in speaking fees from the banks the Fed was in accuse of supervising.

Senior Reporter Jesse Eisinger of ProPublica Tweeted this: "Deeply troubling 2-fisted money grab from banks by Janet Yellen. This is corruption, simply isn't called that because it's so quotidian." Eisinger added: "Sure, Yellen might think she tin make independent decisions once in office. But how arrogant is it to imagine that money corrupts everyone simply y'all?"

For more on that subject, encounter our study: Janet Yellen's Greenbacks Booty of $7 Million Is Simply the Tip of the Iceberg; She Failed to Report Her Wall Street Speaking Fees from JPMorgan and Others in 2018.

Like and so many before her, Yellen was rewarded for her fealty to Wall Street and her willingness to accept its dingy money past being nominated and confirmed past the U.South. Senate as President Biden's Treasury Secretary.

Now, if y'all want more reasons to rage confronting "federal incest," consider this: As Treasury Secretary, Yellen is in charge of approving all Fed emergency lending programs to Wall Street; as Treasury Secretary, she has control of a slush fund called the Exchange Stabilization Fund with which she is allowed to meddle in markets; as Treasury Secretary, she Chairs the Financial Stability Oversight Quango (F-SOC) which is immune to hold non-public meetings with the Wall Street regulators.

"Federal incest" also comes to heed when we call up about the trading scandal involving the former President of the Dallas Fed, Robert Kaplan, and Goldman Sachs; and the former President of the Boston Fed, Eric Rosengren, and Citigroup'due south Citibank. While the Fed was supervising both banks and pumping them upwardly with stealthy repo loans, Kaplan and Rosengren had trading relationships with the respective banks. See our report: New Documents Show the Fed'southward Trading Scandal Includes 2 of the Wall Street Banks It Supervises: Goldman Sachs and Citigroup.

And for the cherry on the peak of this grand pile of "federal incest," consider who it is that's investigating this unprecedented trading scandal at the Fed: it's being investigated past the Fed's Inspector General who reports to the Board of the Fed.

It'due south pretty piece of cake to run across why they're talking nigh throwing up on Reddit.

Read the total article hither.

America is run by criminals. They just pulled the greatest coup in probably the history of the homo race, without firing a single shot or sending in a unmarried soldier.

It did not starting time with the outbreak of COVID in 2020, but information technology started in the Autumn of 2019 where they enriched themselves with the capital they needed to pull off this coup, and then their puppet politician, fellow Wall Street Billionaire Donald Trump, followed their directions to implement Operation Warp Speed to get the cistron-altering injections produced and injected into the population, decimating our military in the process.

If you don't want to live every bit slaves and watch the entire annihilation of future generations, and so there is just ane path forward, and it goes through Wall Street and the Federal Reserve and the banks that own them.

In that location is no other manner.

Information technology's fourth dimension to follow the money, and expose Anybody who is benefiting from feeding at the trough of dirty money. And I guarantee you, at that place is Large money on the Correct, in the Conservative movement that wants to bring Trump back into power.

Virtually of these talking head medical professionals in the Alternative Media right at present are probably office of the Right that is funded through these banks, and y'all need to research Everyone correct now who claims to exist a vox for truth, and detect out who pulls their strings based on who is supporting them financially.

And that includes many of the heavyweights in the Alternative Media who claim to be against the COVID-19 "vaccines." If they are a non-profit soliciting funds from you, demand to come across their IRS 990 form to run across how much of their revenue comes from minor contributions, and how much comes from big donors.

They don't have to normally list their donors' names, only you could enquire them if any of their donors include Wall Street businesses or investment firms, and see if they answer. Look at how much their board of directors are making.

If it is a medical doctor, search their proper name in Open Payments to see if they are getting kickbacks from drug companies, because that is where most of this money they created goes right now, straight into the pockets of Large Pharma.

I have stated publicly, and volition state again here in this article, that I earn my income through my own company, Healthy Traditions, that will be twenty years old in March this year. Nobody else funds me, and if well-meaning readers send me a check to back up our news sites, I ship it dorsum to them.

Health Impact News is at present existence censored by most in the Alternative Media, as many outlets that used to promote and republish our articles stopped doing so late last year when I exposed Donald Trump for the fraud that he is.

So I get the special privilege now of beingness attacked by the Left and their corporate media for being anti-vaccine, and now past the Correct for not supporting Billionaire Corporate lapdog Donald Trump.

Merely that's fine, considering I do not publish these manufactures for fiscal proceeds. I publish them because I am committed to the Truth, wherever that leads, and the Truth is a person, not a political philosophy or credo.

Jesus answered, "I am the way and the truth and the life. No one comes to the Begetter except through me. (John 14:6)

Comment on this article at HealthImpactNews.com.

See Also:

Understand the Times We are Currently Living Through

What Happens When a Holy and Righteous God Gets Angry? Lessons from History and the Prophet Jeremiah

Who You Let to Ascertain "Sickness" Determines if You Live in Slavery, or Liberty

Insider Exposes Freemasonry as the Earth's Oldest Secret Religion and the Luciferian Plans for The New World Club

Identifying the Luciferian Globalists Implementing the New World Guild – Who are the "Jews"?

Fact Check: "Christianity" and the Christian Religion is NOT Plant in the Bible – The Person Jesus Christ Is

What is Life?

The Most Important Truth about the Coming "New Globe Order" Almost Nobody is Discussing

The Seal and Marking of God is Far More Important than the "Mark of the Beast" – Are You lot Prepared for What's Coming?

The Satanic Roots to Modern Medicine – The Marker of the Animate being?

Medicine: Idolatry in the Twenty Beginning Century – 6-Year-Old Article More than Relevant Today than the 24-hour interval it was Written

Having problems receiving our newsletters? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Minds.com, MeWe, and Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find united states of america on Minds.com, MeWe, and Telegram, as well as Bitchute and Odysee for further instructions about where to detect united states of america.

If you use the TOR Onion browser, hither are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Affect News, Vaccine Touch, Medical Kidnap, Created4Health, CoconutOil.com.

Leaving a lucrative career every bit a nephrologist (kidney doctor), Dr. Suzanne Humphries is now free to actually aid cure people.

In this autobiography she explains why practiced doctors are constrained inside the current corrupt medical system from practicing existent, upstanding medicine.

One of the sane voices when it comes to examining the science behind modern-solar day vaccines, no pro-vaccine extremist doctors have e'er dared to debate her in public.

-

Volume – The Vaccine Courtroom, by Wayne Rohde – 240 pages

"The Dark Truth of America's Vaccine Injury Bounty Program"

Complimentary Shipping Available!

Guild HERE!

Published on January four, 2022

maitlandwitena1952.blogspot.com

Source: https://vaccineimpact.com/2022/censored-4-5-trillion-bank-bailout-4th-quarter-2019-months-before-covid-exceeded-2008-bailouts/